Introduction

In the dynamic world of business, ensuring that projects are delivered on time and meet quality standards is paramount. A performance bond serves as a critical tool in achieving this goal. But what exactly is a performance bond? How Swiftbonds features can understanding its definition shape your business strategy? This article delves into the intricacies of performance bonds, providing insights on how they can be effectively integrated into your business model for optimal benefit.

What is the Performance Bond Definition?

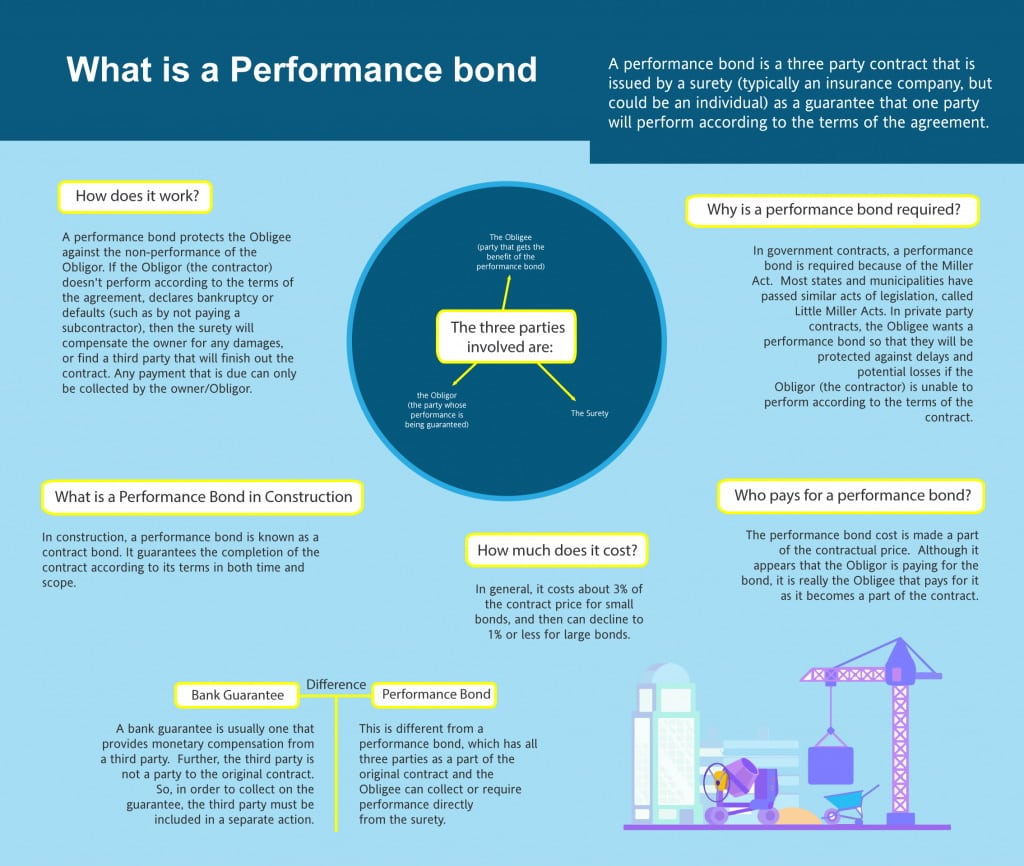

A performance bond is essentially a guarantee issued by a third party, typically a bank or an insurance company, to ensure that a contractor fulfills their contractual obligations. If the contractor fails to meet these obligations, the bond covers any financial losses incurred by the project owner.

Key Elements of a Performance Bond

Principal: The party who is required to perform the work. Obligee: The party that requires the bond for protection. Surety: The entity that provides the bond and guarantees that the principal will fulfill their obligations.Types of Performance Bonds

- Contractor Performance Bonds: These cover construction projects and ensure contractors complete their work according to specifications. Maintenance Bonds: These provide coverage for maintenance issues after project completion.

Understanding these elements is crucial when determining how to utilize the definition of a performance bond in your business strategy.

Why Use Performance Bonds in Business?

Utilizing performance bonds not only protects your investment but also enhances your credibility in the market. By demonstrating financial responsibility and reliability through bonding, businesses can attract more clients and secure larger contracts.

Advantages of Implementing Performance Bonds

- Risk Mitigation: Reduces financial risk associated with contractor underperformance. Enhanced Credibility: Builds trust with clients and stakeholders. Compliance Requirements: Many public sector projects mandate performance bonds.

How to Implement Performance Bonds in Your Contracts

Integrating performance bonds into your contracts involves several steps:

Identify Projects Requiring Bonds: Determine which contracts would benefit from added security. Select Qualified Surety Companies: Research firms known for reliability and reputation. Negotiate Terms with Contractors: Discuss bond requirements during contract negotiations.Checklist for Implementing Performance Bonds

| Step | Action Item | |------|-------------| | 1 | Assess project risks | | 2 | Choose appropriate bond type | | 3 | Consult with legal advisors | | 4 | Finalize terms with surety |

The Role of Performance Bonds in Risk Management

Performance bonds are an essential component of risk management strategies in construction and other industries. They act as safety nets, ensuring that financial resources are available should issues arise during project execution.

Creating a Risk Management Plan with Performance Bonds

Identify Potential Risks: Evaluate risks specific to your industry. Determine Bond Coverage Levels: Assess how much coverage is necessary based on project scope. Monitor Contractor Compliance: Regularly check that contractors adhere to agreed-upon standards.Common Misconceptions about Performance Bonds

Despite their benefits, several misconceptions surrounding performance bonds can cloud judgment:

Myth #1: Only Large Projects Require Them

Many small businesses think only large-scale projects need bonds; however, even smaller projects can benefit from added security.

Myth #2: They’re Too Expensive

While there is a cost involved, many businesses find that the long-term savings from mitigating risk far outweigh these expenses.

How to Choose the Right Surety Company

Selecting a reputable surety company is crucial for obtaining reliable performance bonds:

Factors to Consider When Choosing Surety Companies

- Reputation & Financial Stability Experience in Your Industry Customer Service Quality

Tips for Evaluating Sureties

- Request references from previous clients. Check ratings from agencies like A.M. Best or Standard & Poor’s.

Performance Bond Costs Explained

Understanding how costs are determined can help businesses budget appropriately:

Cost Factors Include

Contract Amount Type of Work Contractor’s CreditworthinessTable of Sample Costs

| Contract Amount | Estimated Bond Cost (%) | |-------------------|-------------------------| | $100,000 | 0.5% - 3% | | $500,000 | 0.5% - 2% | | $1 Million | 0.25% - 1% |

How to Use the Definition of a Performance Bond in Your Business Strategy

To effectively leverage this concept within your business strategy:

Recognize its role as a risk management tool. Educate stakeholders about its importance. Utilize it as leverage when negotiating contracts with new clients or contractors.This proactive approach not only safeguards your interests but also positions you as a responsible player within your industry landscape.

Case Studies Illustrating Effective Use of Performance Bonds

Examining real-world examples helps clarify how businesses have successfully implemented performance bonds:

Case Study #1: Construction Firm A

Firm A secured multiple large contracts using performance bonds which demonstrated reliability, leading to increased project wins.

Case Study #2: Tech Startup B

Startup B used bonds during its initial phase to assure investors it would deliver on timeframes outlined within contracts.

Frequently Asked Questions (FAQs)

Q1: What happens if a contractor defaults?

A1: If a contractor fails to fulfill their obligations, the surety company compensates the obligee up to the amount specified in the bond.

Q2: Are there different types of performance bonds?

A2: Yes! Common types include contractor performance bonds and maintenance bonds tailored for specific needs.

Q3: How do I know if I need a performance bond?

A3: Assess project size, complexity, and client requirements; consult legal or financial advisors if unsure.

Q4: Can I get bonded without good credit?

A4: It may be challenging; however, some sureties specialize in working with lower credit scores by requiring higher premiums or collateral.

Q5: Do all states require performance bonds?

A5: No; requirements vary by state and industry—always verify local regulations before proceeding.

Q6: What documentation do I need to obtain a performance bond?

A6: Typical documents include financial statements, proof of experience, and details regarding past projects completed successfully.

Conclusion

Incorporating an understanding of what constitutes a performance bond into your business strategy is not just beneficial—it's essential for protecting investments and enhancing credibility within competitive markets. By recognizing its role as both a risk management tool and an assurance mechanism for stakeholders, you position yourself Swiftbonds favorably against competitors who may overlook this valuable resource. As you move forward, consider how best to integrate this knowledge into everyday operations while fostering relationships built on trust and reliability—key ingredients for long-term success in any industry!