Introduction

In the world of business, credit scores often play a crucial role in determining financial opportunities. A solid business credit score can open doors to better bonding rates, which is particularly important if you're looking to secure contracts and funding. Understanding how to improve your business credit score for better bond rates is essential for any entrepreneur hoping to thrive in a competitive landscape.

In this comprehensive guide, we will delve deep into the intricacies of business credit scores and bonding companies, exploring various strategies that can significantly enhance your financial standing. From understanding what factors contribute to your credit score to actionable steps you can take today, this article aims to equip you with the knowledge needed for success.

How to Improve Your Business Credit Score for Better Bond Rates

Improving your business credit score isn’t just about numbers; it’s about creating a robust financial identity that instills confidence in lenders and bonding companies alike. But where do you start? Let’s break it down into manageable parts and explore how you can effectively enhance your business's credibility.

Understanding Business Credit Scores

What Is a Business Credit Score?

A business credit score is a numerical representation of your company's creditworthiness, typically ranging from 0 to 100. It reflects how well you've managed credit and debts in the past. This score is crucial not just for loans but also for securing bonds—contracts that guarantee financial obligations will be met.

How Are Business Credit Scores Calculated?

Your business credit score is often calculated using data from various sources including payment histories, outstanding debts, length of credit history, and public records such as bankruptcies or liens. Companies like Dun & Bradstreet, Equifax, and Experian each have their methodologies for rating businesses.

Why Is Your Business Credit Score Important?

Impact on Bonding Rates

A higher business credit score usually translates into lower bonding rates. Bonding companies assess risk based on your financial history; a strong score indicates reliability and responsibility, making it more likely you’ll receive favorable terms.

Influence on Loan Approvals

Banks types of performance bonds and other lending institutions look closely at your business credit score when considering loan applications. A poor score may lead to higher interest rates or even denial.

Key Factors That Affect Your Business Credit Score

1. Payment History

Your track record of paying bills on time holds significant weight in determining your business credit score.

2. Amounts Owed

The total amount of debt compared to available credit influences how lenders perceive your risk level.

3. Credit Mix

Having a diverse mix of accounts (like loans, lines of credit, etc.) can positively impact your score.

4. Length of Credit History

Older accounts tend to be viewed favorably because they demonstrate stability over time.

5. New Credit Inquiries

Frequent requests for new credits can signal financial distress and negatively affect your score.

Strategies to Improve Your Business Credit Score

1. Establish Strong Vendor Relationships

Building trust with suppliers who report payments can enhance your payment history—an essential factor in calculating your business credit score.

2. Pay Bills Promptly

Late payments are detrimental; aim for early or on-time payments whenever possible.

3. Monitor Your Credit Report Regularly

Check for inaccuracies that could be dragging down your score—correcting these mistakes is vital for improvement.

4. Maintain Low Balances on Open Accounts

Keep debt levels manageable by utilizing less than 30% of available credit limits whenever possible.

5. Diversify Your Credit Portfolio

Consider taking out different types of loans or lines of credits to create a balanced mix that lenders appreciate.

6. Register with Commercial Credit Bureaus

Ensure you're listed with major bureaus such as Dun & Bradstreet or Experian so they have accurate information about your company’s finances.

Bonding Companies: Who They Are and What They Do

What Is a Bonding Company?

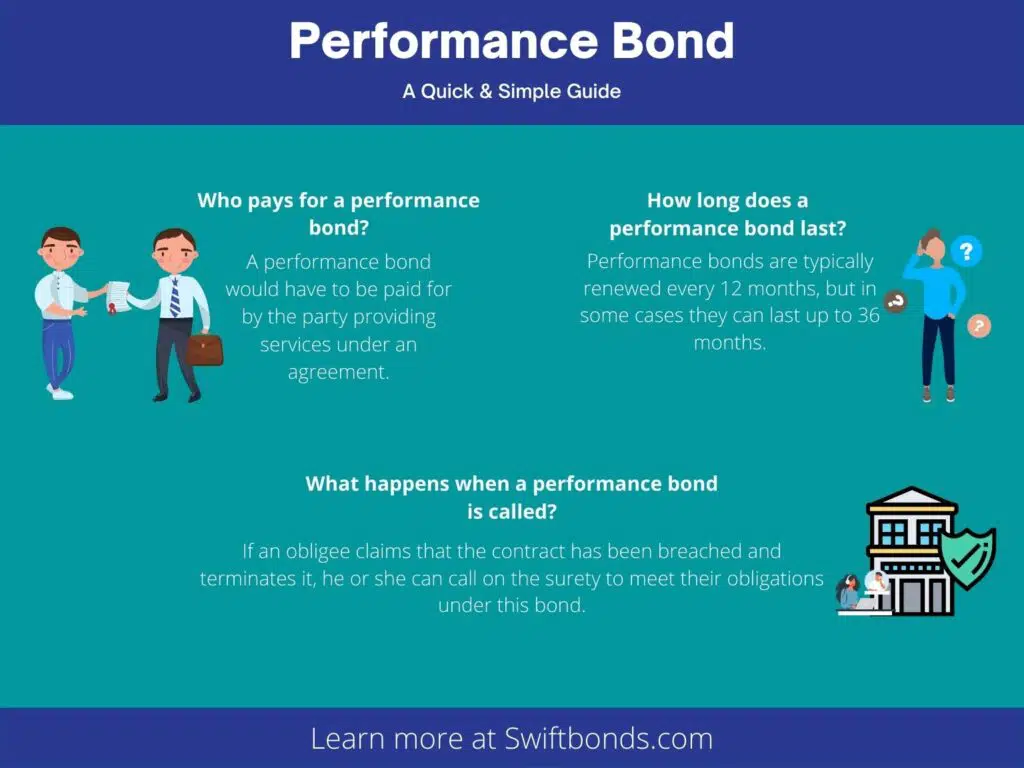

Bonding companies provide surety bonds that protect the obligee against losses if the bonded party fails to fulfill contractual obligations.

Types of Bonds Offered by Bonding Companies

- Performance Bonds Payment Bonds Bid Bonds Maintenance Bonds

Each type serves different purposes but fundamentally ensures compliance with contractual agreements.

How Bonding Companies Assess Risk

1. Analyzing Financial Statements

Bonding companies closely examine balance sheets and income statements during their assessment phase.

2. Evaluating Work History

Your previous performance on similar contracts can heavily influence their decision-making process.

3. Checking Background Information

They’ll look into any legal issues or claims made against you that might raise red flags.

FAQs About Improving Business Credit Scores

FAQ 1: How long does it take to improve my business credit score?

Improving your business credit score can take anywhere from several months to years depending on current circumstances and efforts taken towards improvement.

FAQ 2: Can I check my own business credit report without affecting my score?

Yes! Checking your own report is considered a "soft inquiry," which does not impact your overall score at all.

FAQ 3: What should I do if I find errors on my report?

Contact the reporting agency immediately with documentation supporting your claim; they are obligated by law to investigate disputes within 30 days.

FAQ 4: Are there services that help improve my business credit score?

Absolutely! Many services specialize in helping businesses build their scores through strategic planning and advice tailored specifically for you.

FAQ 5: Does my personal credit affect my business’s ability to secure bonds?

In many cases yes; especially if you're a sole proprietor or if personal guarantees are involved in financing options related to the bond you're seeking.

FAQ 6: Is there a minimum required score for receiving bonds?

While there isn’t a universal minimum required; generally speaking, scores above 70 are considered favorable by most bonding companies.

Conclusion

Understanding how to improve your business credit score for better bond rates isn't merely an exercise in number-crunching; it’s about establishing credibility in the marketplace—a necessary ingredient for success in today’s competitive environment. By following the strategies laid out above—from establishing strong vendor relationships to monitoring your reports regularly—you'll position yourself favorably not only with bonding companies but within all facets of finance associated with running a successful venture.

In summary, improving your business's financial reputation will pave the way for more opportunities—so why wait? Start implementing these strategies today!